← Back to Home

USER NEEDS

The insights that shaped the financial experience

Our research combined field interviews in Togo and Benin with a benchmark analysis of fintech solutions performing well across the subregion (Abidjan, Senegal, Ghana).

TOGO & BENIN

70 - 86% Mobile Money penetration

< 20% app usage

1/ A Market built on USSD, not apps

For many, a code was their first interface

Users trusted USSD menus, not visual interfaces; setting expectations around:

- simple, linear, guided steps

- immediate feedback

- clear confirmations

Fees: ---

Commissions : ---

2/ Merchants & Agents, operating with limited visibility

Without clarity, every transaction becomes guesswork

Merchants and agents worked across telco wallets, cash, and spreadsheets, with no unified place to track or reconcile payments.This created daily friction and uncertainty around transaction status, balances, and cash flow.

3/ BCEAO rules shaping the Flow

Compliance wasn’t optional, it shaped the experience

BCEAO regulation defined strict requirements for:

- onboarding and KYC tiers

- transaction limits

- error handling and reporting

4/ Learning from what already works

The region already showed what simplicity looks like

Benchmarking fintech leaders in Senegal, Ghana, and Côte d’Ivoire revealed consistent success patterns:

- radical simplicity

- transparent fees

- strong confirmation loops

- reliability, even on poor networks

WHAT CHANGED ?

Impact & Outcomes

Successful early-2025 launch

Launched Gozem’s first end-to-end financial experience across Users, Drivers, Agents, and Merchants, introducing a unified wallet and money flows; without disrupting the existing in-app journey.

Strong early activation

Users quickly began topping up through Gozem Money, kiosks, and partner channels, showing that the new experience felt intuitive, discoverable, and naturally integrated into the app’s existing flow

Faster cross-team delivery

Shared patterns for amount entry, method selection, confirmations, and receipts enabled product and engineering teams to ship new money flows faster and more consistently, reducing alignment overhead and rework.

Ready for multi-market rollout

The modular structure of the flows required only minimal changes per country such as local rails, limits, or verification rules; allowing Gozem to scale the financial experience across markets without altering the core user journey

← BACK TO GOZEM MONEY PROJECTS

FINAL DESIGNS

Core experiences & Flow walkthroughs

I designed the core money experiences as a single, coherent system, optimized for fast adoption, trust, and scalability. Each flow follows the same interaction principles while adapting to different user contexts and constraints.

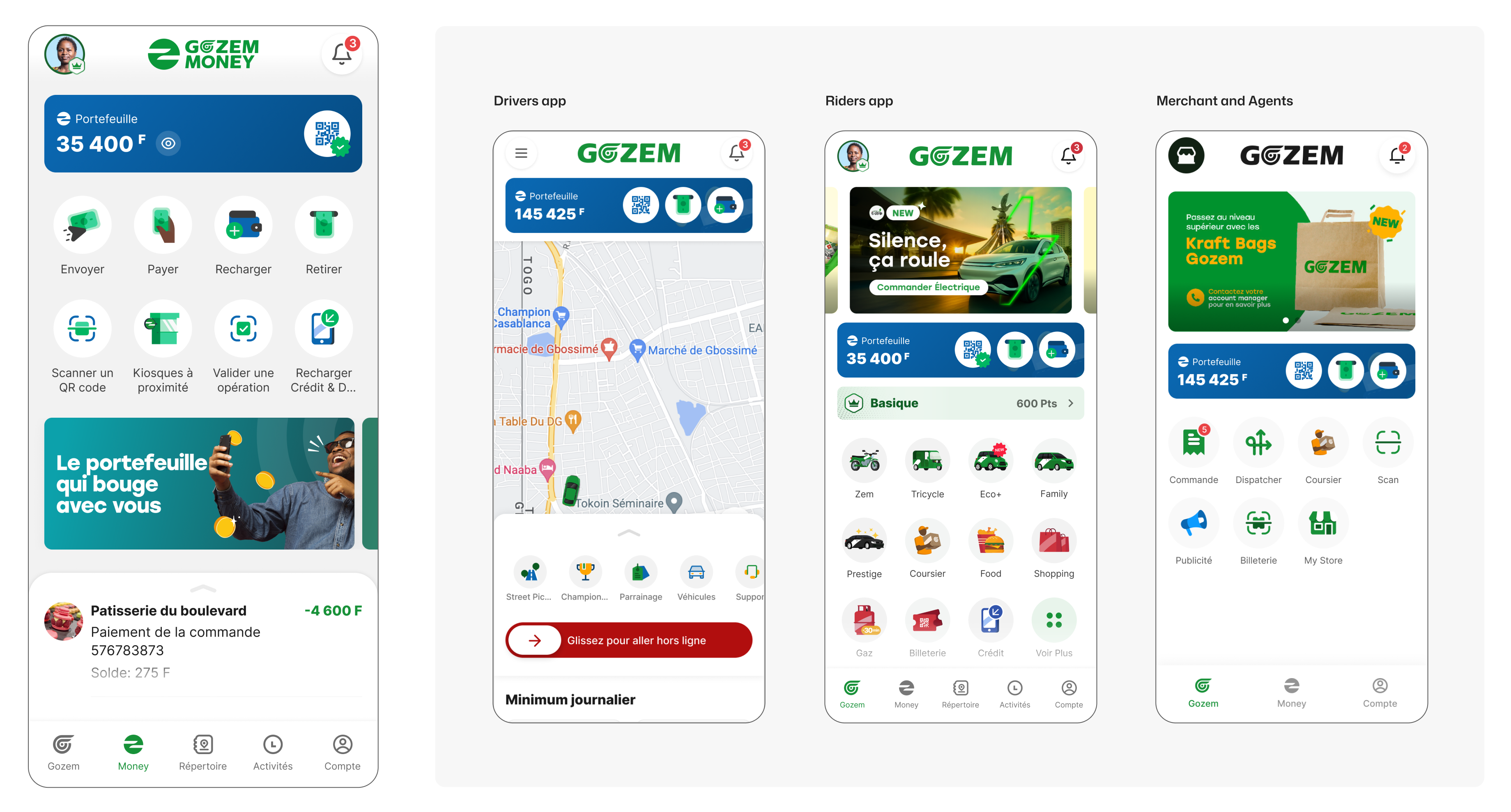

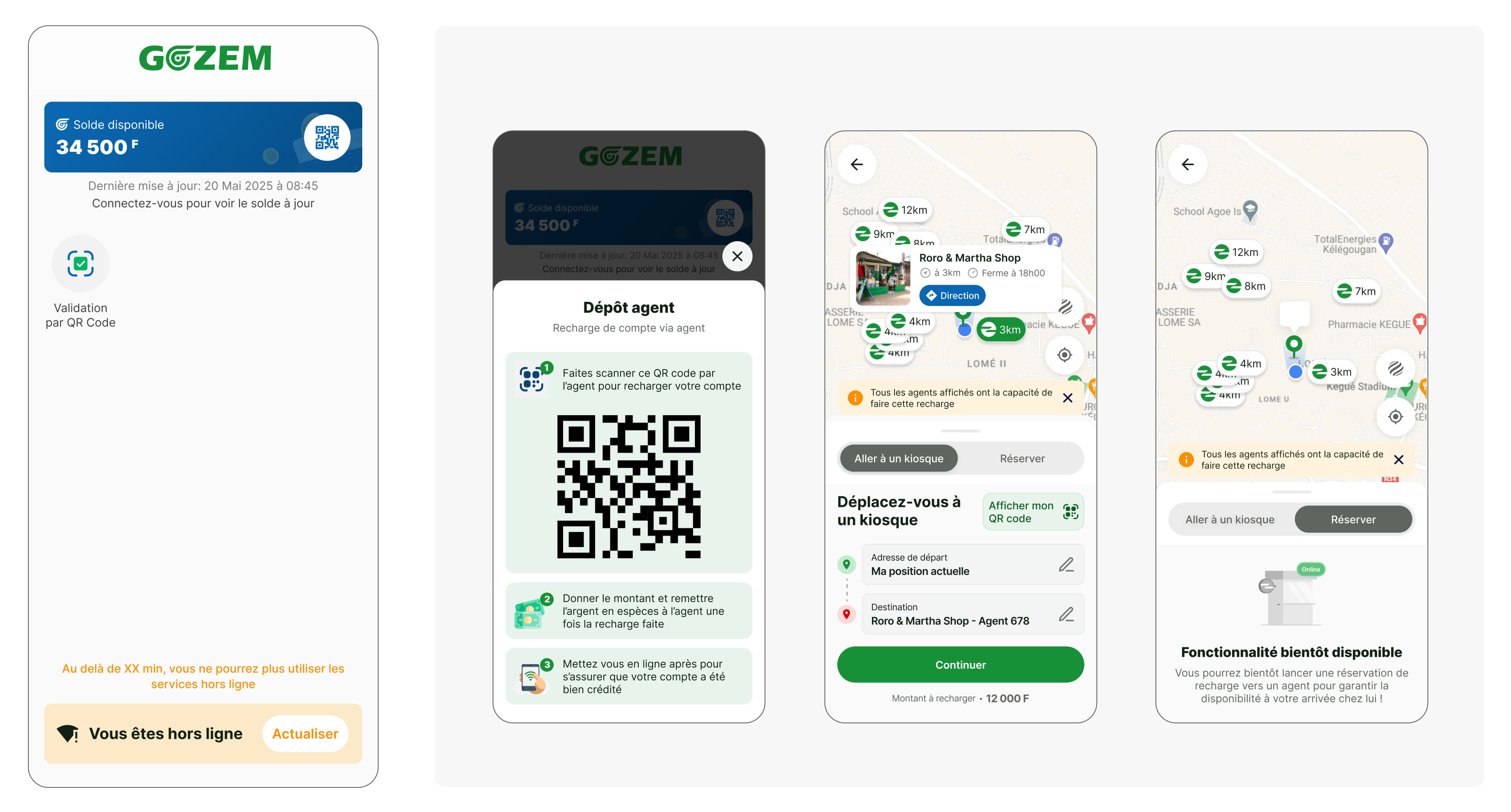

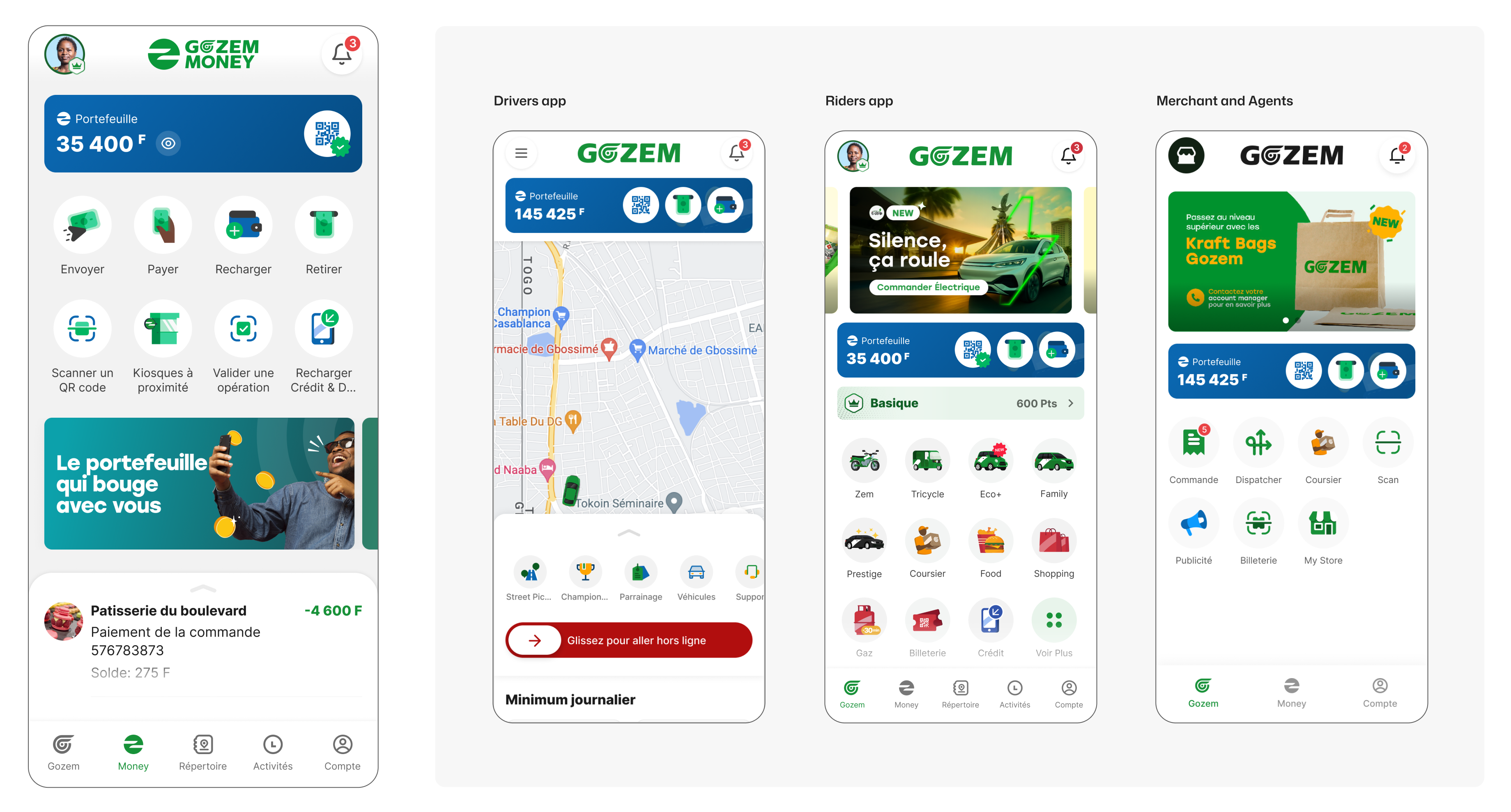

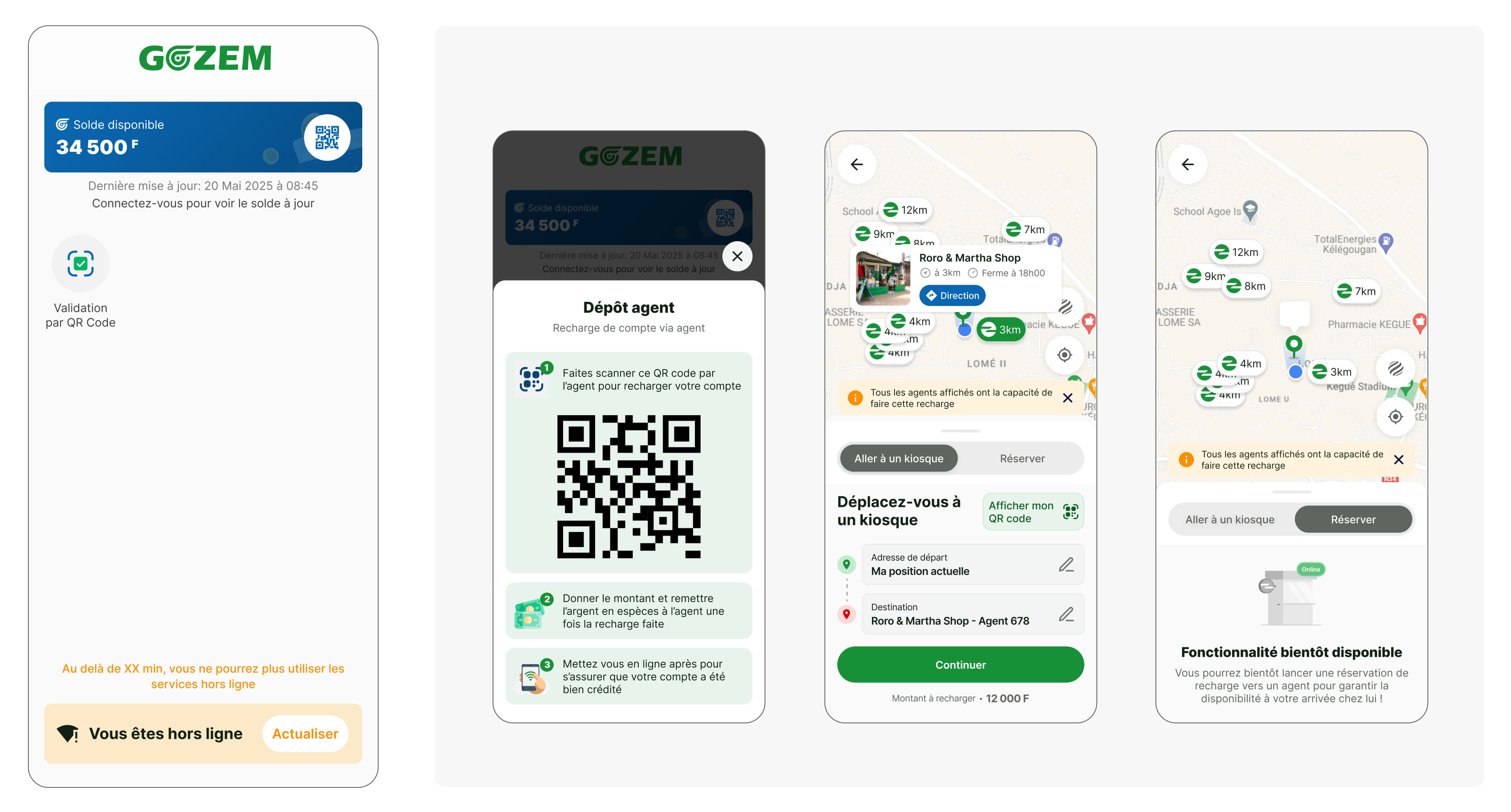

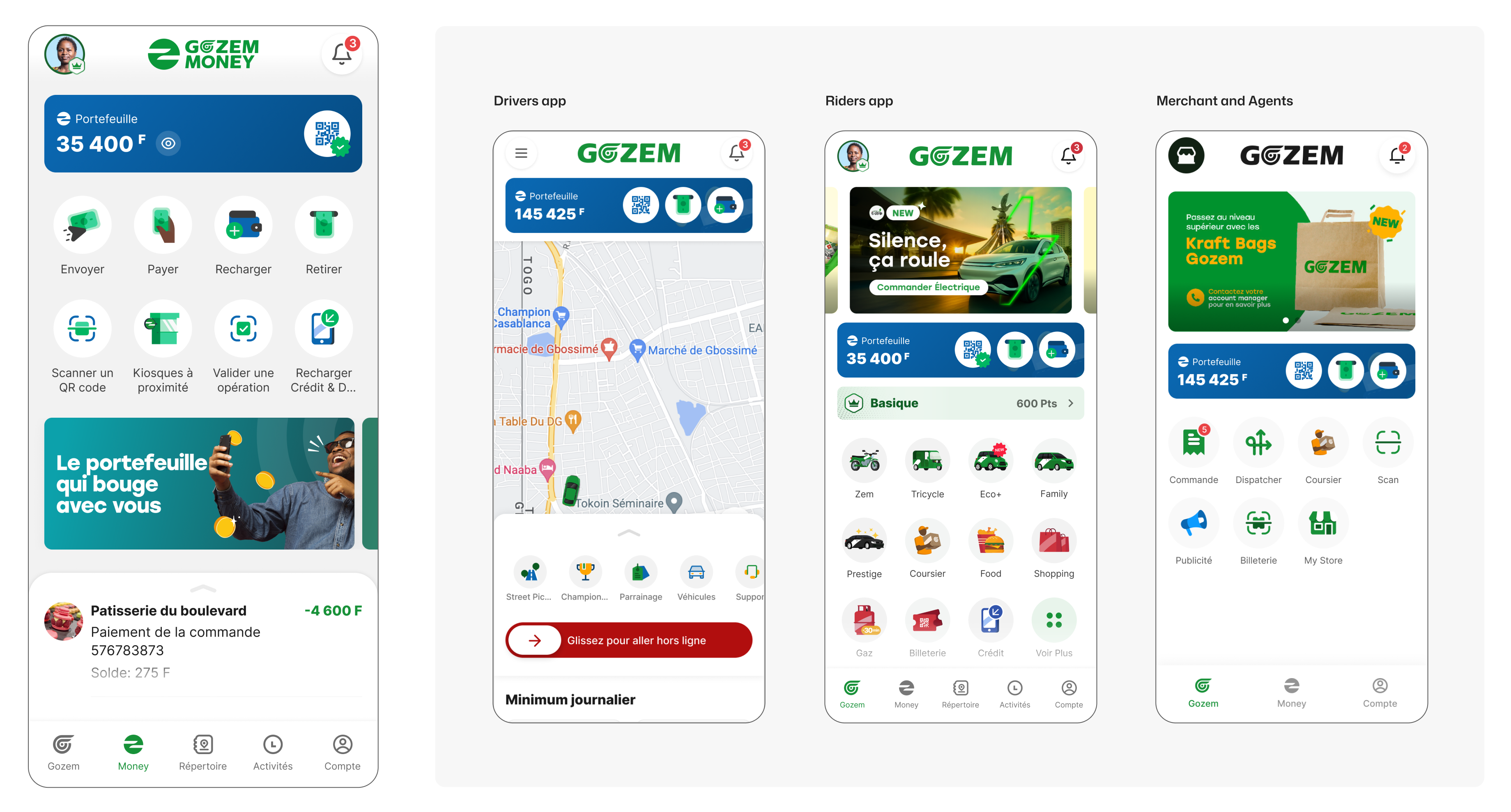

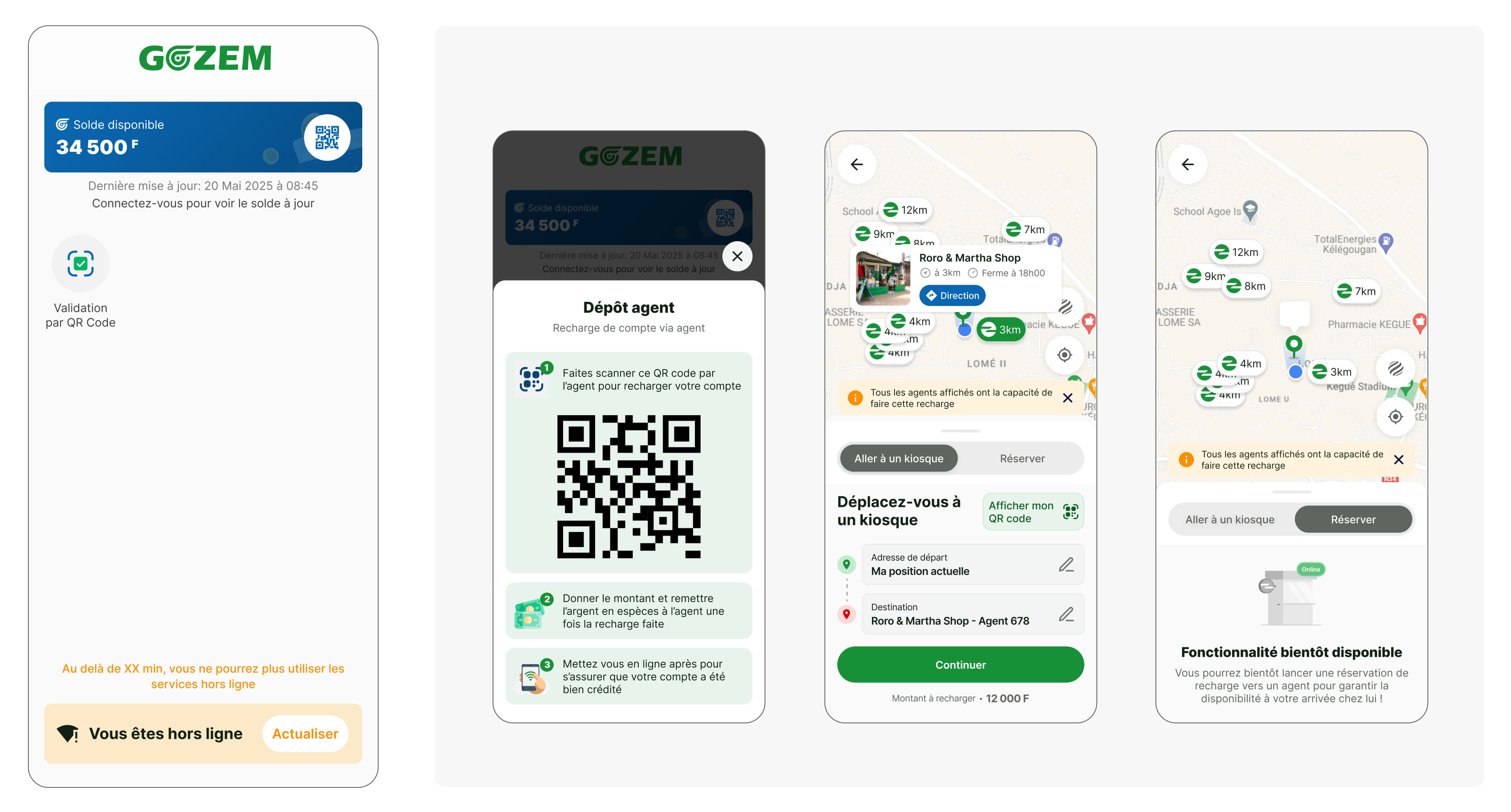

Homepage & Wallet

One unified wallet card across User, Driver, Agent, and Merchant apps.

Same core actions (Send, Pay, Top Up, Withdraw, Scan) and behavior everywhere.

Clear balance visibility and predictable interaction patterns.

Users learn it once, and it works across the entire Gozem ecosystem

P2P transfer

Amount entered first to prevent failed flows due to insufficient balance or limits

Beneficiary, then method, since one contact may have multiple accounts (telco, bank, Gozem); this enables choosing the right rail within one unified pattern

Double verification (recap + PIN summary) to reinforce trust and reduce transfer errors

A guided, confidence-building transfer flow adapted to the region’s multi-rail realities

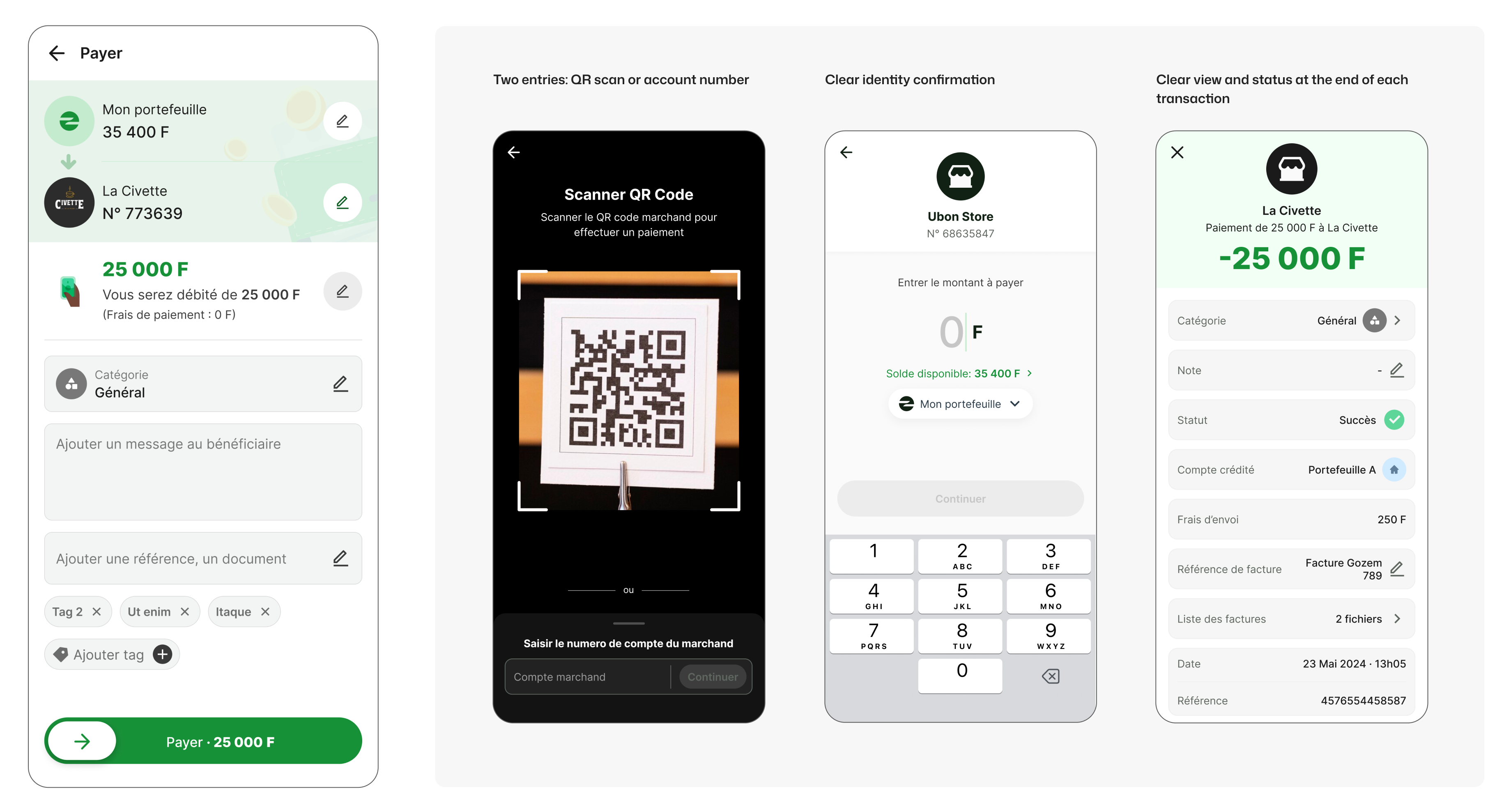

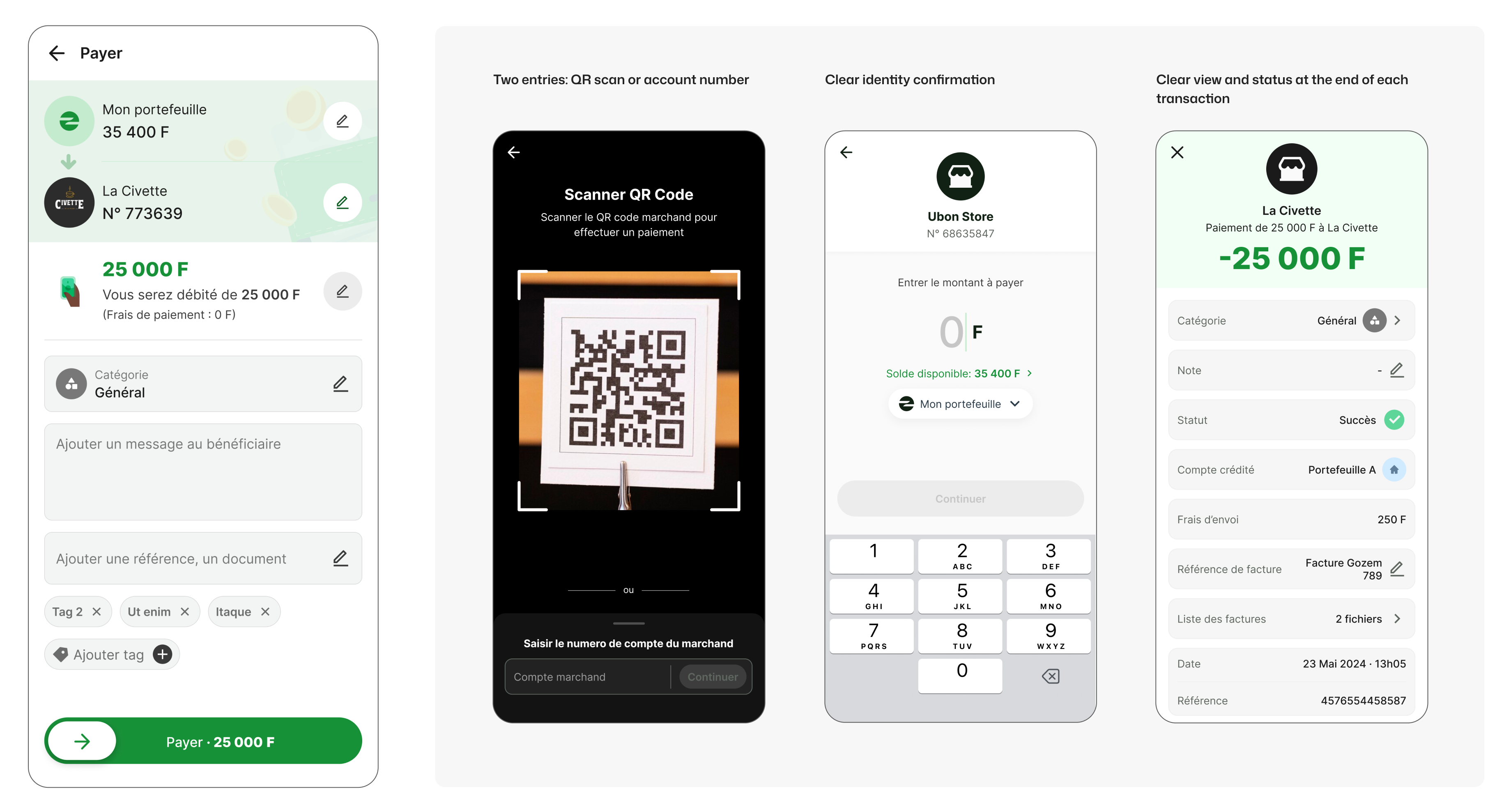

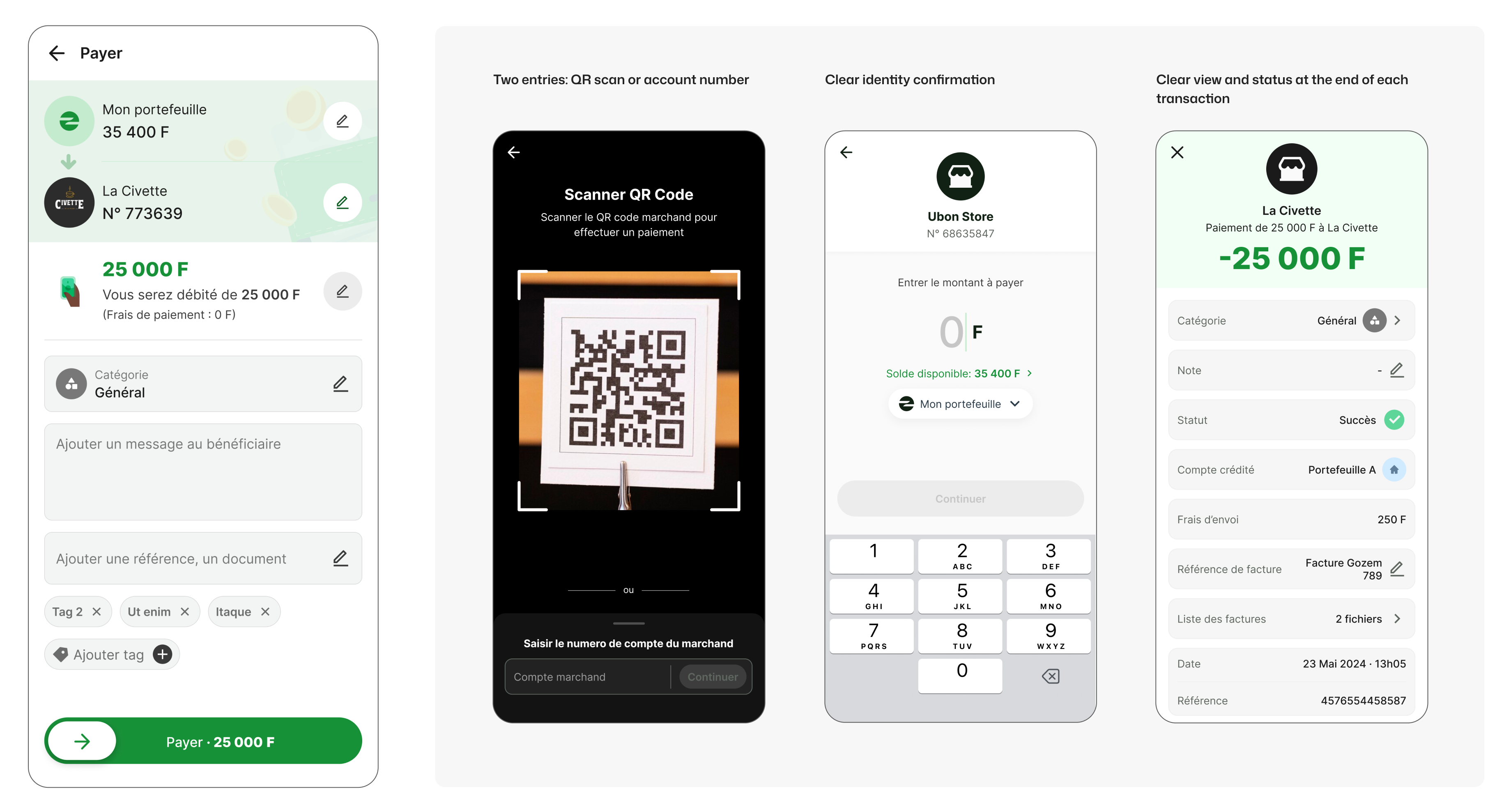

Merchant payment

Two entry modes; users can scan a QR code or manually enter the merchant’s number, ensuring flexibility across in-store and informal contexts

Clear identity confirmation; the merchant’s name, logo, and account details are shown upfront to prevent mistakes and build trust

Transaction clarity at every step; amount, fees, and funding source remain visible throughout the flow

A fast, transparent payment flow that reduces errors, adapts to varied merchant setups, and reassures users at every step

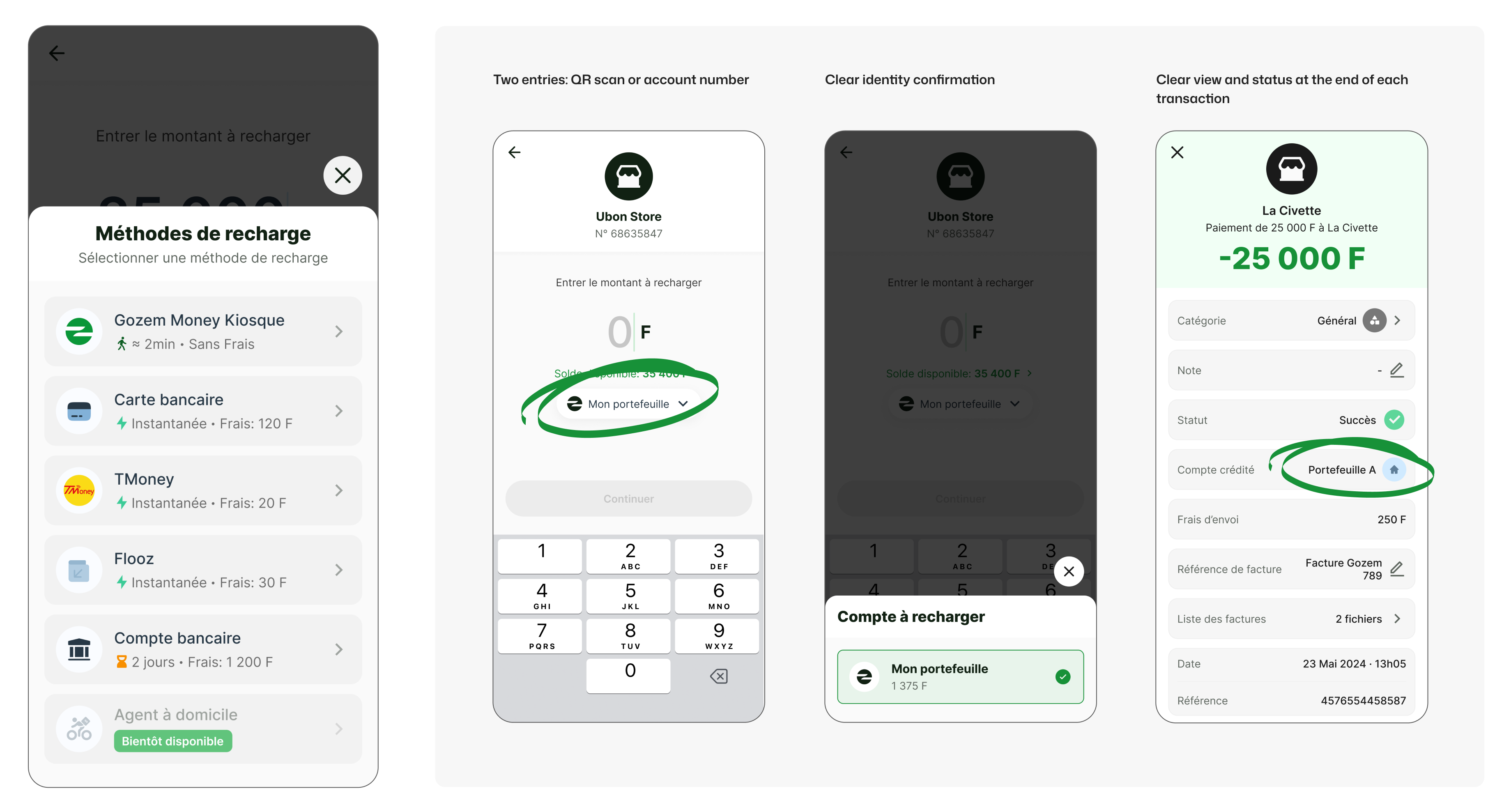

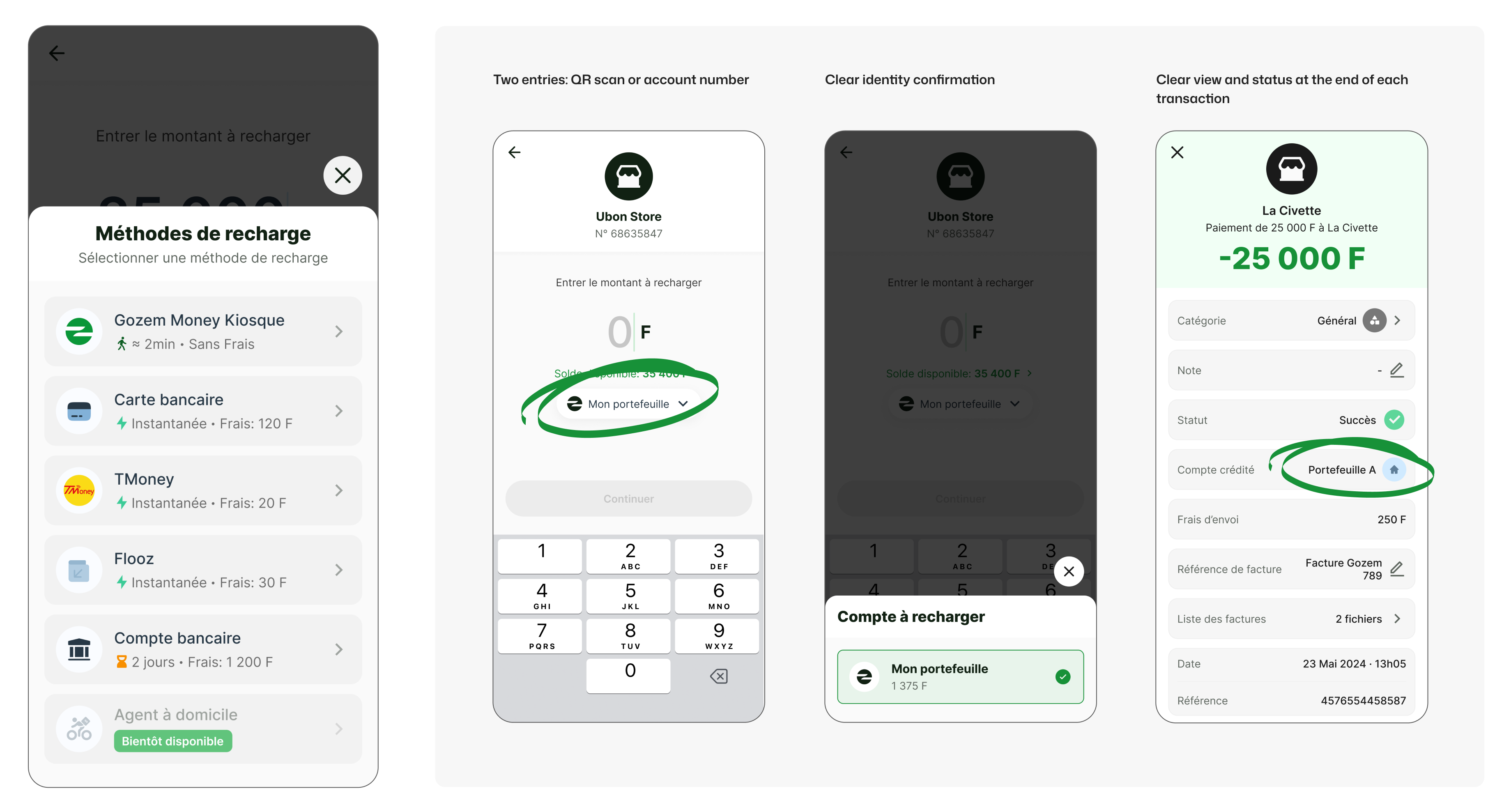

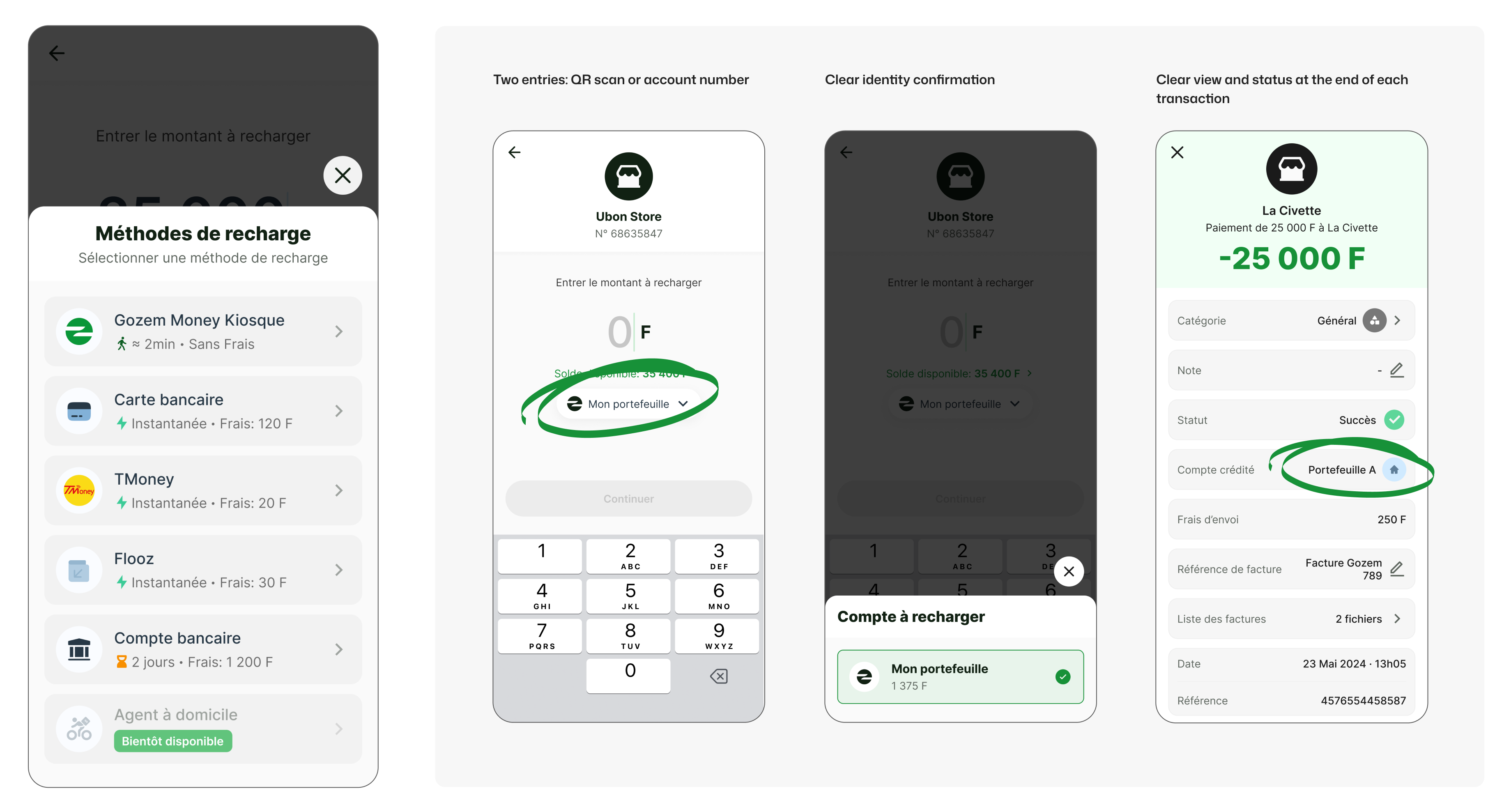

Designing for future growth

The method step is fully adaptable, allowing different rails per country (telcos, banks, agents, PSPs) without changing the user journey

Key steps were designed as reusable building blocks to accommodate features like budgeting, shared wallets, ...

UI and logic anticipate variations in fees, limits, verification rules, and regulatory constraints, ensuring the product scales beyond Togo

A financial experience that solves today’s needs while already prepared for new wallets, new rails, and new markets

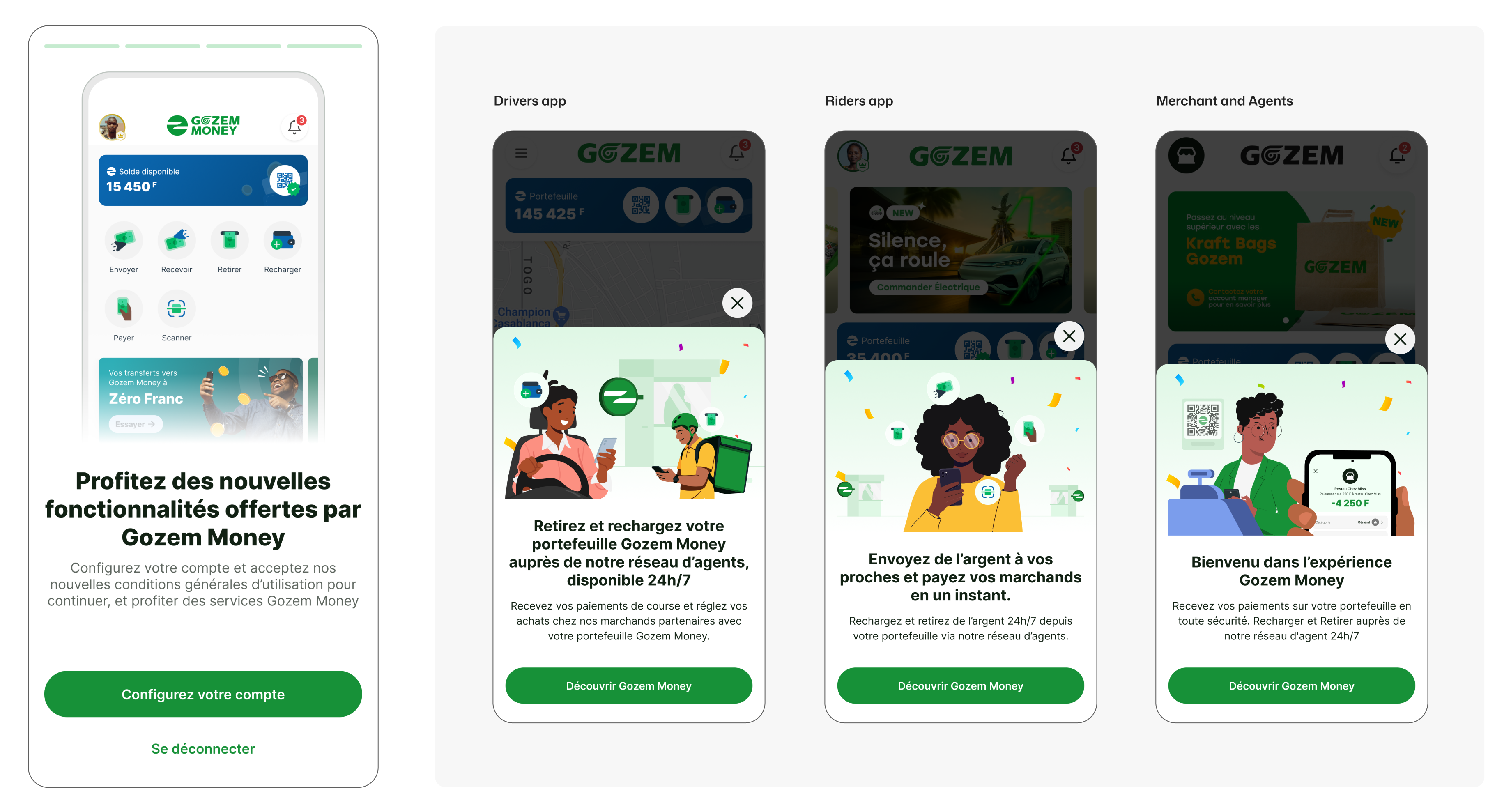

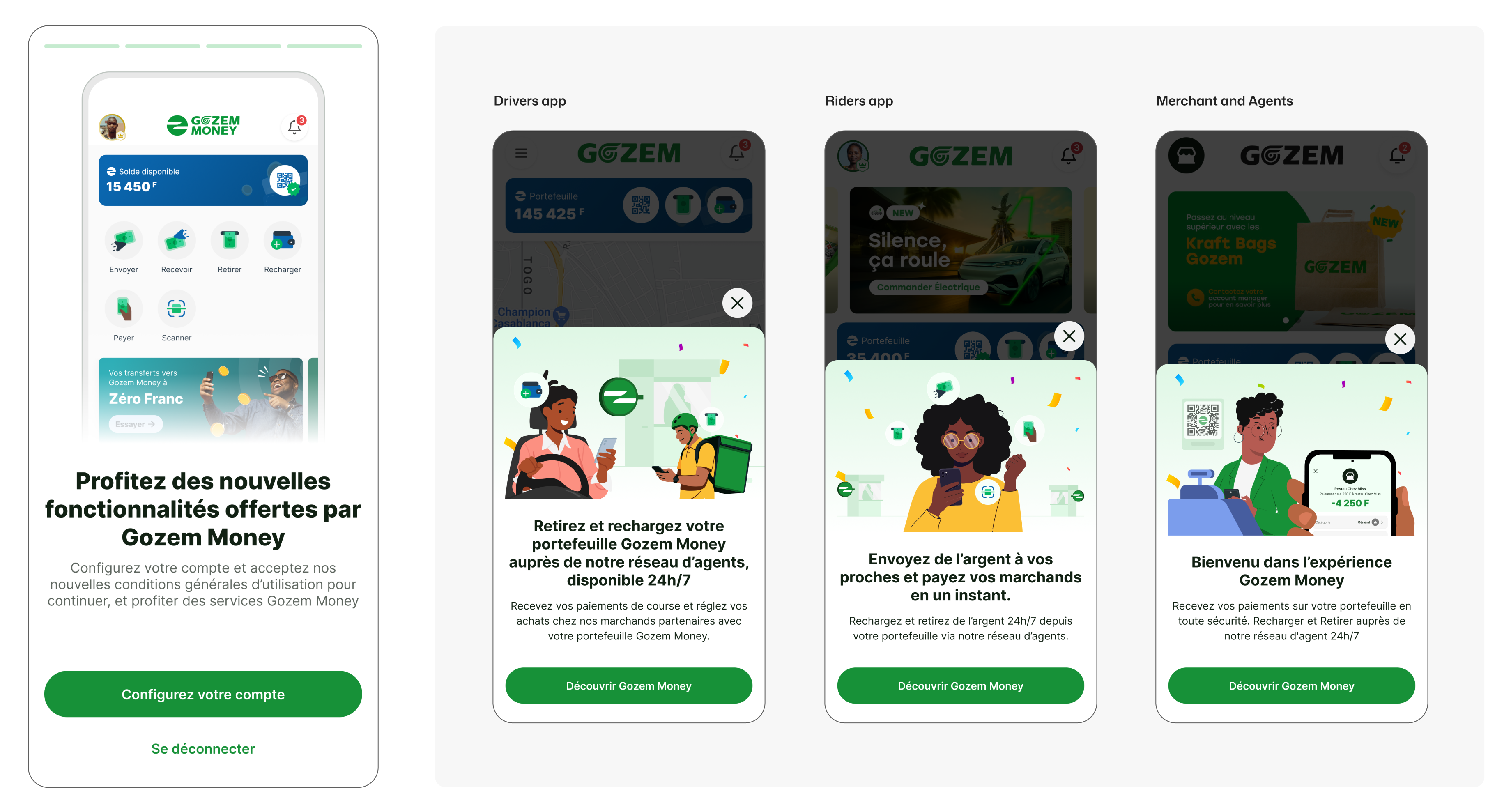

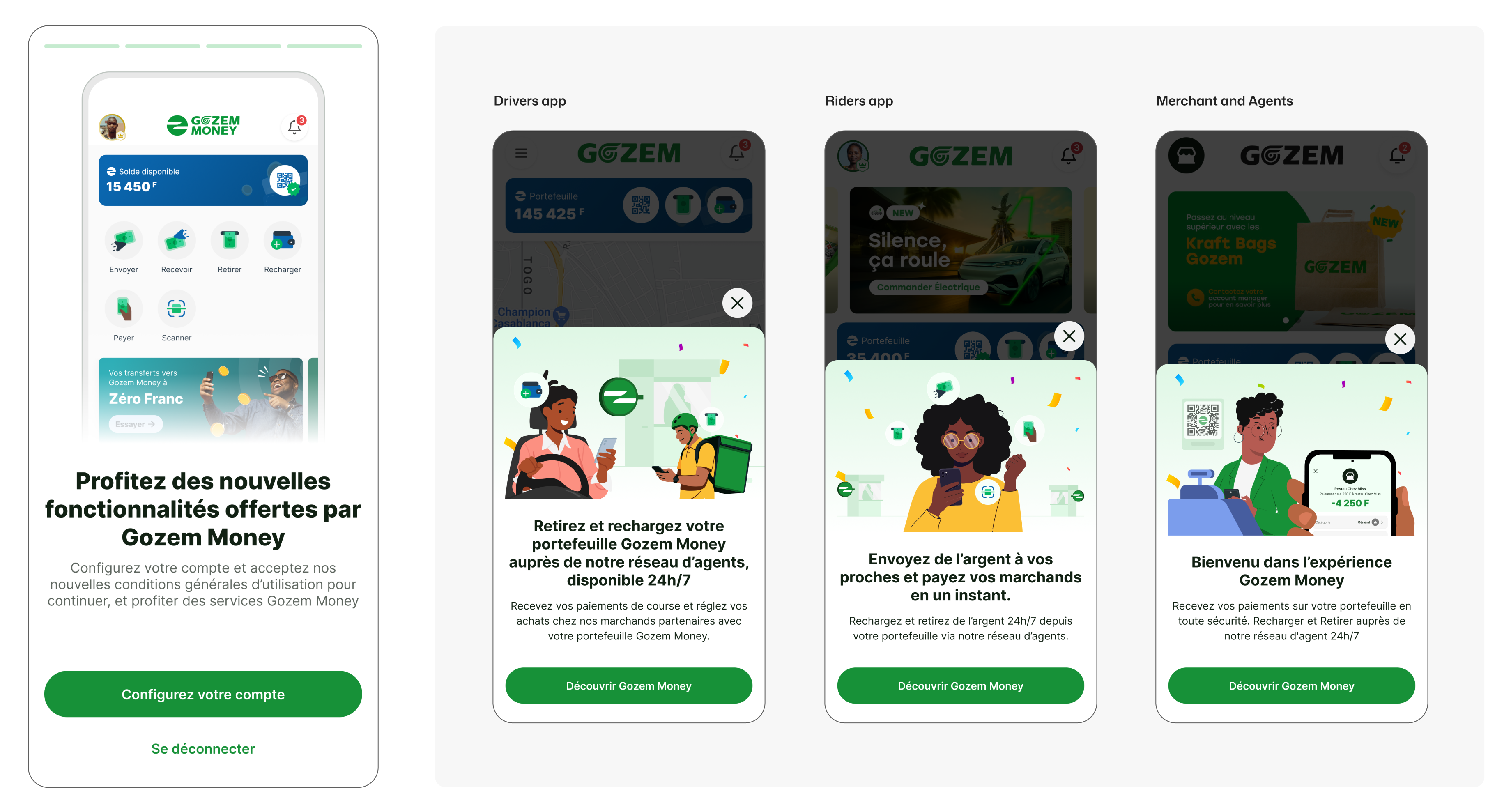

Guiding adoption through smart onboarding

Users are seamlessly activated when they are migrated to Gozem Money, with a simple, low-friction way to discover their wallet and first actions

New capabilities (P2P, payments, top-ups, etc.) are revealed inside the experience, not through heavy tutorials, ensuring users learn by doing

Short, in-flow explanations clarify fees, limits, and transaction states, helping users accustomed to USSD understand what’s happening

Faster adoption, clearer understanding, and higher user confidence with minimal friction.

Standing out through ecosystem-driven innovation

Offline mode; designed fallback states allowing users and agents to complete or resume key actions even in low-connectivity environments

Ride-to-Kiosk integration; users without cash-in points nearby can book a ride directly to the closest kiosk from the money experience

A solution rooted in local realities and elevated by Gozem’s ecosystem

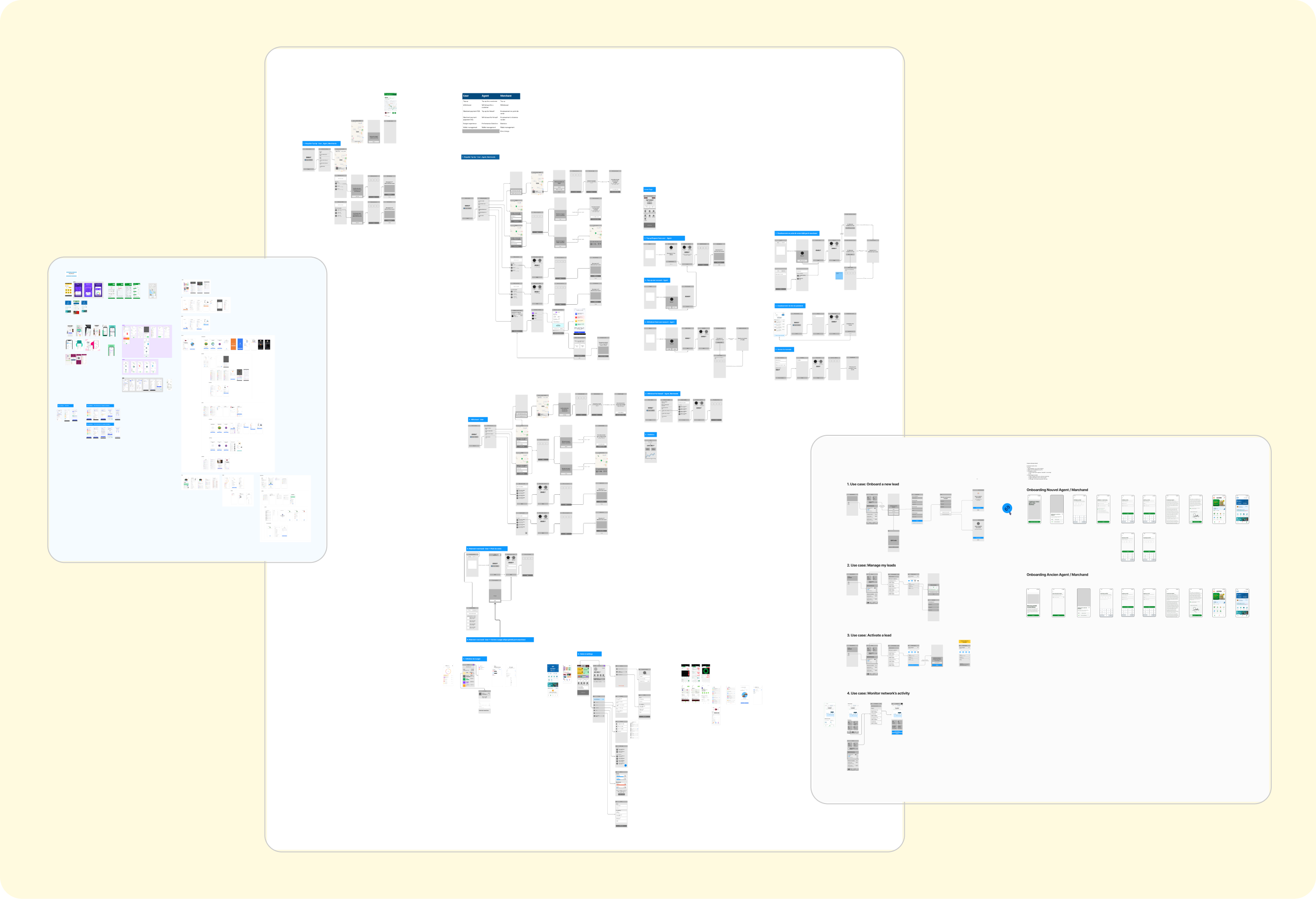

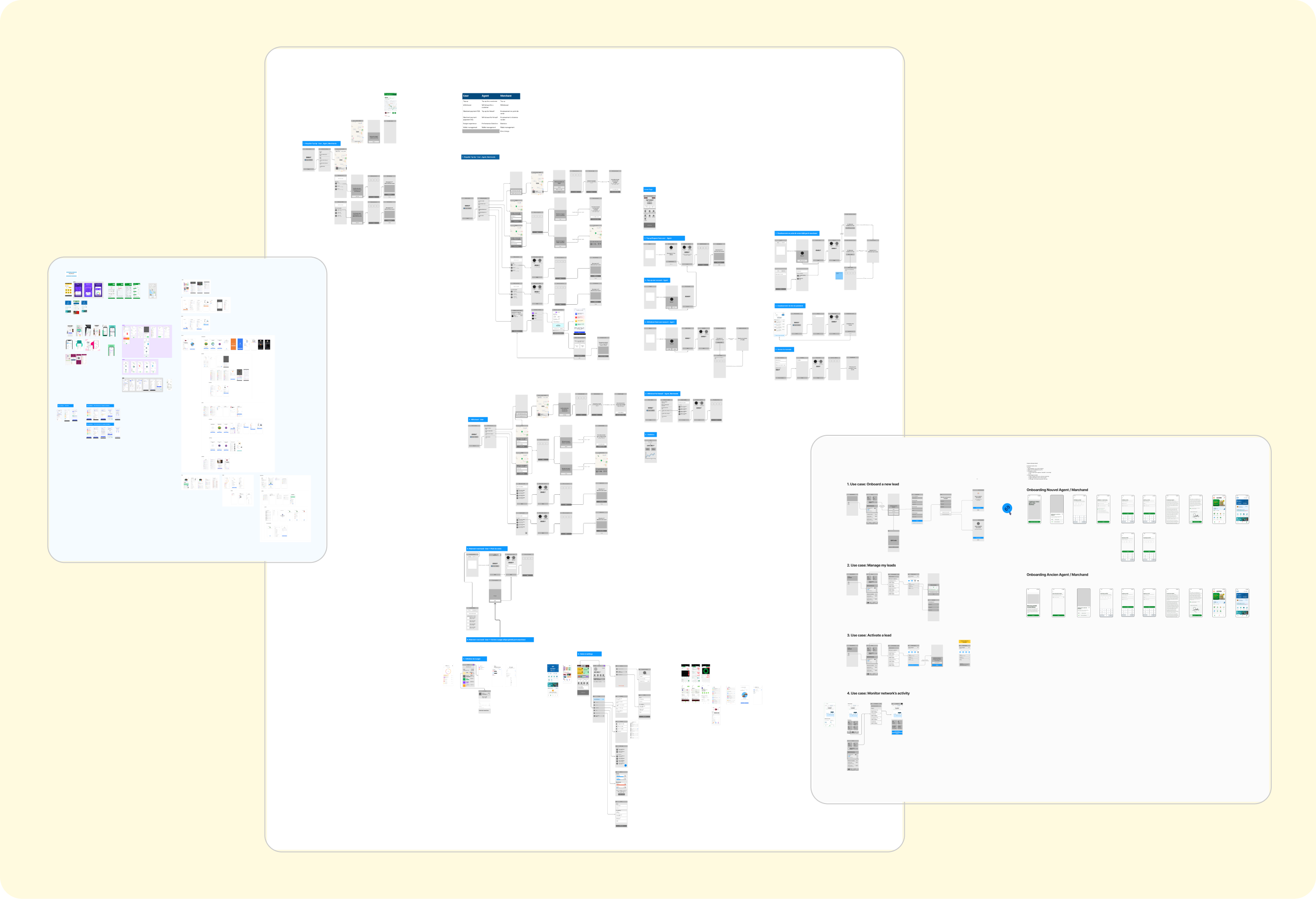

EXPLORATION

Exploring the design direction

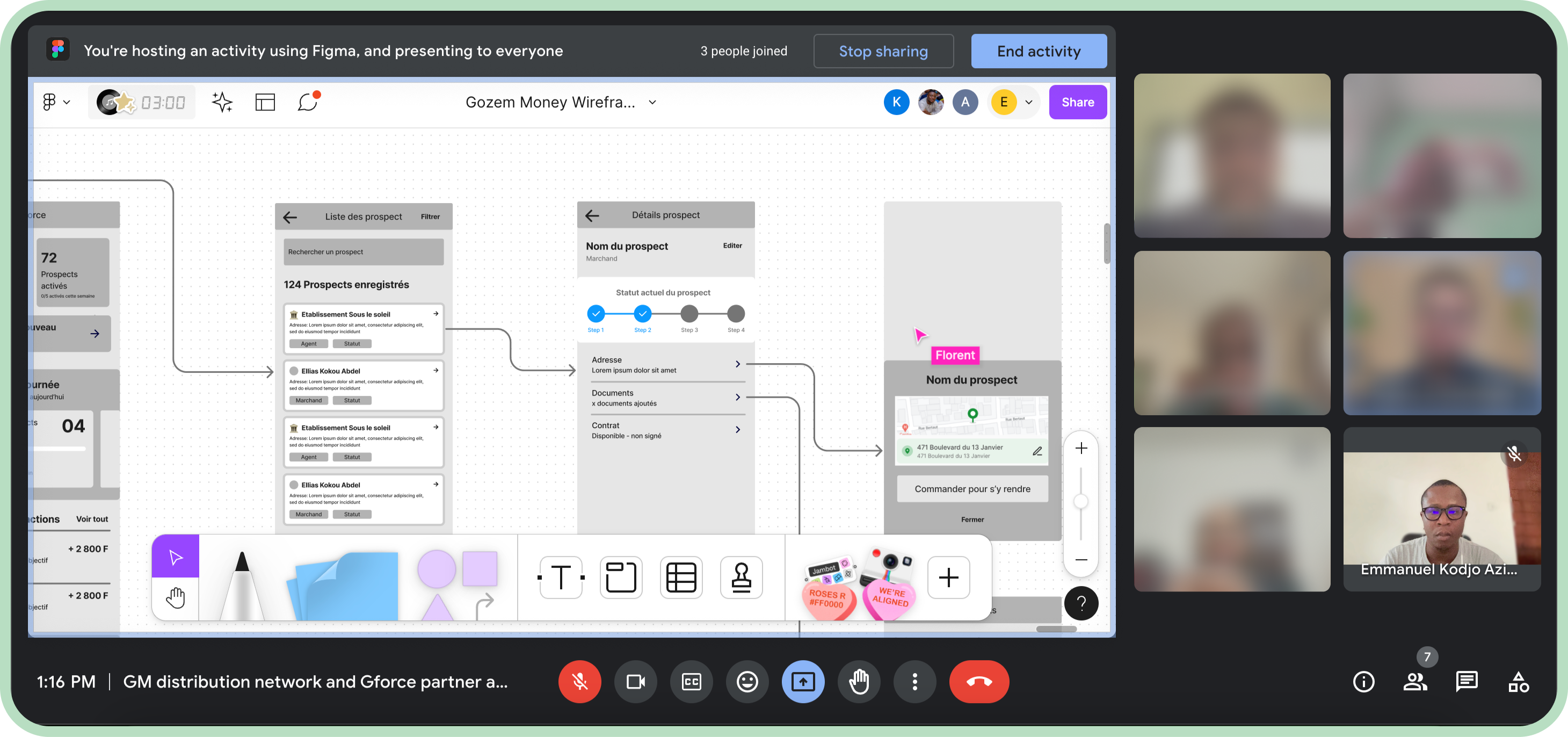

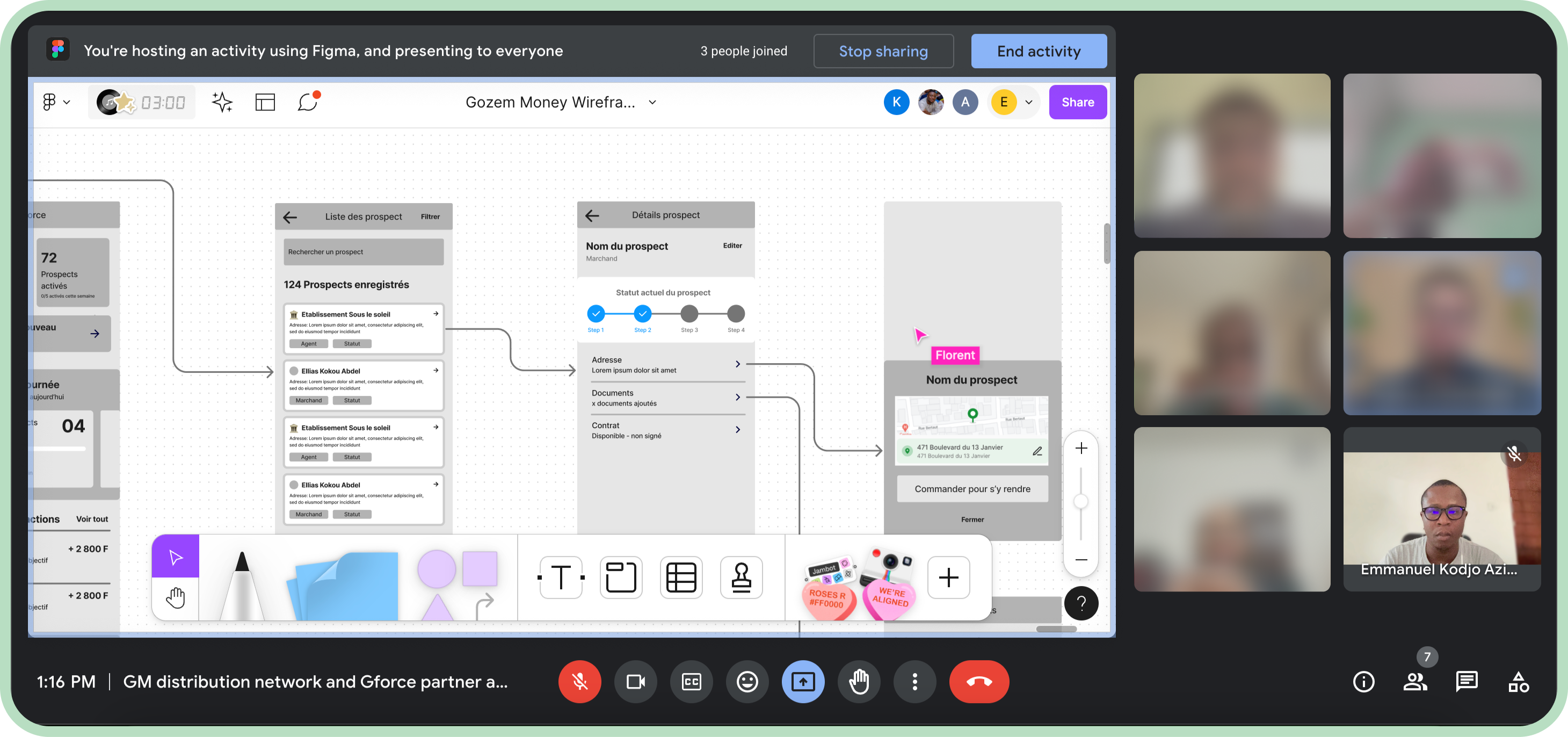

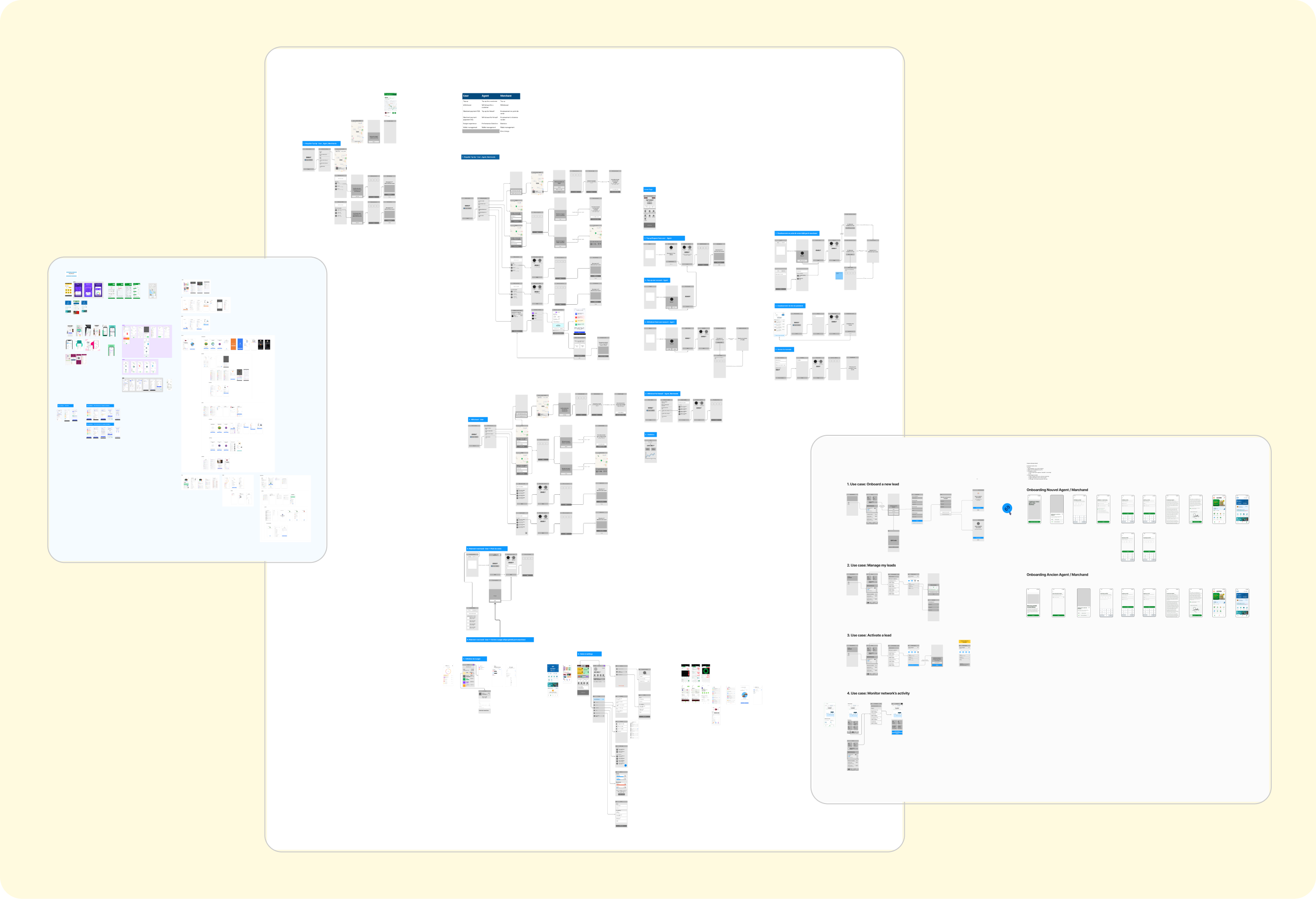

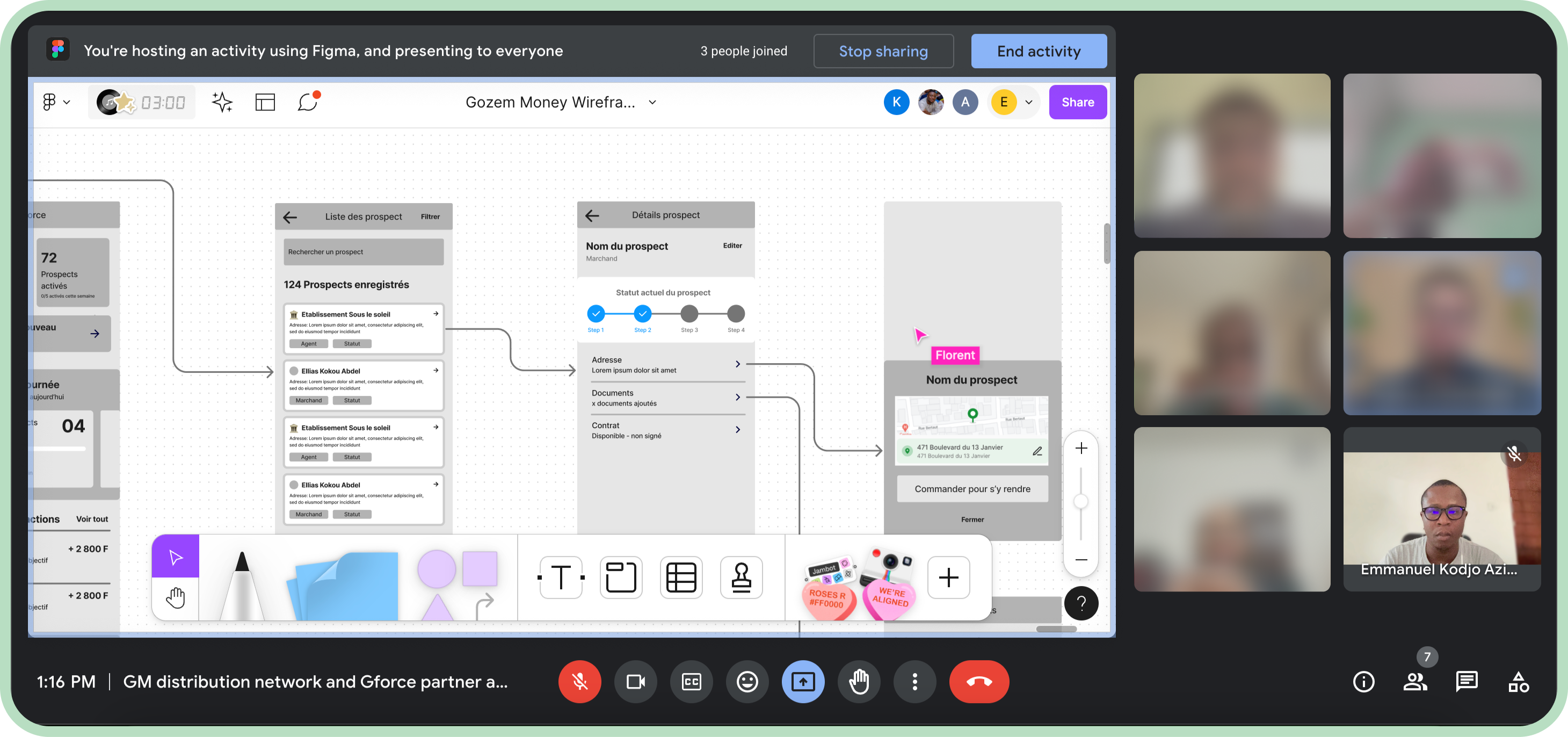

Before locking any solution, I explored multiple experience directions to ensure fast adoption, cross-market scalability, and long-term extensibility. These explorations were reviewed and aligned with product, engineering, and leadership to validate user impact, operational feasibility, and business goals.

1/ Adoption-first money flows for USSD-native users

I explored different levels of guidance, confirmations, and step granularity in core money flows.

Outcome

A clear baseline for P2P, Topup and payment journeys with fewer steps, explicit confirmations, and predictable states, reducing confusion during early testing.

2/ Consistency across wallet-powered experiences

I mapped how money interactions should behave across transport, ecommerce, and standalone transfers.

Outcome

Standardized patterns for transaction states, confirmations, and error handling that increased user confidence in early validation.

4/ Future-proofing the financial experience

I explored how upcoming features such as savings, multi-accounts, and budgeting could fit into existing flows.

Outcome

A modular experience structure that supports new financial features without redesigning core journeys.

3/ Trust and reliability at critical moments

I evaluated how fees, statuses, delays, and errors were communicated throughout transactions.

Outcome

Standardized patterns for transaction states, confirmations, and error handling that increased user confidence in early validation.

Key Decisions (Validated & Aligned)

- Adopt guided, step-based flows as the core interaction pattern: Applied consistently across P2P transfers, merchant payments, agent operations, and top-ups to support fast adoption and clarity.

- Establish a single wallet experience across all Gozem services: Ensured consistency and reduced fragmentation across transport, ecommerce, financial flows, and top-ups.

- Define shared UX patterns for all money interactions: Enabled design and product teams to align on balances, transaction states, confirmations, and trust signals, accelerating delivery while maintaining quality.

The challenge

Gozem needed to introduce its first financial experience and design it from zero, while ensuring it worked seamlessly across four distinct ecosystems: users, drivers, agents, and merchants. Each group had different goals, constraints, and levels of familiarity with digital money.

In our launch markets, money movement was almost entirely USSD-based, not app-based. This meant the experience had to feel immediately understandable, reassuring, and predictable, while still offering the benefits of a modern, app-driven money flow.

The solution also had to scale across services (transport, delivery, ecommerce) and support future additions like multi-accounts, savings, and budgeting without disrupting existing behaviors.

My role was to lead the end-to-end design of this new financial layer; defining the experience principles, core flows, interactions, and patterns that could serve four ecosystems consistently while supporting Gozem’s long-term fintech expansion.

Objective

Design a simplified, trusted P2P and merchant payment experience from scratch, create a scalable financial foundation ready for future features (budgeting, multi-wallets, savings), and establish design standards that align all Gozem products.

My Role

Leadership

Product Design

Co-research

User Testing

Tools

Figma

Jira

Illustrator

After Effect

Cross-Collaboration

Product

Engineering

Data

CEOs & Heads

Legal

Marketing

Building the mobile foundation for Gozem’s financial services

How I shaped a flexible, system-driven foundation designed to scale across markets, support evolving financial products, and deliver a consistent, high-trust experience for every user

← Back to Home

USER NEEDS

The insights that shaped the financial experience

Our research combined field interviews in Togo and Benin with a benchmark analysis of fintech solutions performing well across the subregion (Abidjan, Senegal, Ghana).

1/ A Market built on USSD, not apps

For many, a code was their first interface

Users trusted USSD menus, not visual interfaces; setting expectations around:

- simple, linear, guided steps

- immediate feedback

- clear confirmations

TOGO & BENIN

70 - 86% Mobile Money penetration

< 20% app usage

Fees: ---

Commissions : ---

2/ Merchants & Agents, operating with limited visibility

Without clarity, every transaction becomes guesswork

Merchants and agents worked across telco wallets, cash, and spreadsheets, with no unified place to track or reconcile payments.This created daily friction and uncertainty around transaction status, balances, and cash flow.

3/ BCEAO rules shaping the Flow

Compliance wasn’t optional, it shaped the experience

BCEAO regulation defined strict requirements for:

- onboarding and KYC tiers

- transaction limits

- error handling and reporting

4/ Learning from what already works

The region already showed what simplicity looks like

Benchmarking fintech leaders in Senegal, Ghana, and Côte d’Ivoire revealed consistent success patterns:

- radical simplicity

- transparent fees

- strong confirmation loops

- reliability, even on poor networks

WHAT CHANGED ?

Impact & Outcomes

Successful early-2025 launch

Launched Gozem’s first end-to-end financial experience across Users, Drivers, Agents, and Merchants, introducing a unified wallet and money flows; without disrupting the existing in-app journey.

Strong early activation

Users quickly began topping up through Gozem Money, kiosks, and partner channels, showing that the new experience felt intuitive, discoverable, and naturally integrated into the app’s existing flow

Faster cross-team delivery

Shared patterns for amount entry, method selection, confirmations, and receipts enabled product and engineering teams to ship new money flows faster and more consistently, reducing alignment overhead and rework.

Ready for multi-market rollout

The modular structure of the flows required only minimal changes per country such as local rails, limits, or verification rules; allowing Gozem to scale the financial experience across markets without altering the core user journey

← BACK TO GOZEM MONEY PROJECTS

FINAL DESIGNS

Core experiences & Flow walkthroughs

I designed the core money experiences as a single, coherent system, optimized for fast adoption, trust, and scalability. Each flow follows the same interaction principles while adapting to different user contexts and constraints.

Homepage & Wallet

- One unified wallet card across User, Driver, Agent, and Merchant apps.

- Same core actions (Send, Pay, Top Up, Withdraw, Scan) and behavior everywhere.

- Clear balance visibility and predictable interaction patterns.

Users learn it once, and it works across the entire Gozem ecosystem

P2P transfer

- Amount entered first to prevent failed flows due to insufficient balance or limits

- Beneficiary, then method, since one contact may have multiple accounts (telco, bank, Gozem); this enables choosing the right rail within one unified pattern

- Double verification (recap + PIN summary) to reinforce trust and reduce transfer errors

A guided, confidence-building transfer flow adapted to the region’s multi-rail realities

Merchant payment

- Two entry modes; users can scan a QR code or manually enter the merchant’s number, ensuring flexibility across in-store and informal contexts

- Clear identity confirmation; the merchant’s name, logo, and account details are shown upfront to prevent mistakes and build trust

- Transaction clarity at every step; amount, fees, and funding source remain visible throughout the flow

A fast, transparent payment flow that reduces errors, adapts to varied merchant setups, and reassures users at every step

Designing for future growth

- The method step is fully adaptable, allowing different rails per country (telcos, banks, agents, PSPs) without changing the user journey

- key steps were designed as reusable building blocks to accommodate features like budgeting, shared wallets, ...

- UI and logic anticipate variations in fees, limits, verification rules, and regulatory constraints, ensuring the product scales beyond Togo

A financial experience that solves today’s needs while already prepared for new wallets, new rails, and new markets

Guiding adoption through smart onboarding

- Users are seamlessly activated when they are migrated to Gozem Money, with a simple, low-friction way to discover their wallet and first actions

- New capabilities (P2P, payments, top-ups, etc.) are revealed inside the experience, not through heavy tutorials, ensuring users learn by doing

- Short, in-flow explanations clarify fees, limits, and transaction states, helping users accustomed to USSD understand what’s happening

Faster adoption, clearer understanding, and higher user confidence with minimal friction.

Standing out through ecosystem-driven innovation

- Offline mode; designed fallback states allowing users and agents to complete or resume key actions even in low-connectivity environments

- Ride-to-Kiosk integration; users without cash-in points nearby can book a ride directly to the closest kiosk from the money experience

A solution rooted in local realities and elevated by Gozem’s ecosystem

EXPLORATION

Exploring the design direction

Before locking any solution, I explored multiple experience directions to ensure fast adoption, cross-market scalability, and long-term extensibility. These explorations were reviewed and aligned with product, engineering, and leadership to validate user impact, operational feasibility, and business goals.

1/ Adoption-first money flows for USSD-native users

I explored different levels of guidance, confirmations, and step granularity in core money flows.

Outcome

A clear baseline for P2P, Topup and payment journeys with fewer steps, explicit confirmations, and predictable states, reducing confusion during early testing.

2/ Consistency across wallet-powered experiences

I mapped how money interactions should behave across transport, ecommerce, and standalone transfers.

Outcome

Standardized patterns for transaction states, confirmations, and error handling that increased user confidence in early validation.

3/ Trust and reliability at critical moments

I evaluated how fees, statuses, delays, and errors were communicated throughout transactions.

Outcome

Standardized patterns for transaction states, confirmations, and error handling that increased user confidence in early validation.

4/ Future-proofing the financial experience

I explored how upcoming features such as savings, multi-accounts, and budgeting could fit into existing flows.

Outcome

A modular experience structure that supports new financial features without redesigning core journeys.

Key Decisions (Validated & Aligned)

- Adopt guided, step-based flows as the core interaction pattern: Applied consistently across P2P transfers, merchant payments, agent operations, and top-ups to support fast adoption and clarity.

- Establish a single wallet experience across all Gozem services: Ensured consistency and reduced fragmentation across transport, ecommerce, financial flows, and top-ups.

- Define shared UX patterns for all money interactions: Enabled design and product teams to align on balances, transaction states, confirmations, and trust signals, accelerating delivery while maintaining quality.

The challenge

Gozem needed to introduce its first financial experience and design it from zero, while ensuring it worked seamlessly across four distinct ecosystems: users, drivers, agents, and merchants. Each group had different goals, constraints, and levels of familiarity with digital money.

In our launch markets, money movement was almost entirely USSD-based, not app-based. This meant the experience had to feel immediately understandable, reassuring, and predictable, while still offering the benefits of a modern, app-driven money flow.

The solution also had to scale across services (transport, delivery, ecommerce) and support future additions like multi-accounts, savings, and budgeting without disrupting existing behaviors.

My role was to lead the end-to-end design of this new financial layer; defining the experience principles, core flows, interactions, and patterns that could serve four ecosystems consistently while supporting Gozem’s long-term fintech expansion.

Objective

Design a simplified, trusted P2P and merchant payment experience from scratch, create a scalable financial foundation ready for future features (budgeting, multi-wallets, savings), and establish design standards that align all Gozem products.

My Role

Leadership

Product Design

Co-research

User Testing

Tools

Figma

Jira

Illustrator

After Effect

Cross-Collaboration

Product

Engineering

Data

CEOs & Heads

Legal

Marketing

Building the mobile foundation for

Gozem’s financial services

How I shaped a flexible, system-driven foundation designed to scale across markets, support evolving financial products, and deliver a consistent, high-trust experience for every user

← Back to Home

USER NEEDS

The insights that shaped the financial experience

Our research combined field interviews in Togo and Benin and data analysis, with a benchmark analysis of fintech solutions

performing well across the subregion (Abidjan, Senegal, Ghana).

1/ A Market built on USSD, not apps

For many, a code was their first interface

Users trusted USSD menus, not visual interfaces; setting expectations around:

- simple, linear, guided steps

- immediate feedback

- clear confirmations

TOGO & BENIN

70 - 86% Mobile Money penetration

< 20% app usage

Fees: ---

Commissions : ---

2/ Merchants & Agents, operating with limited visibility

Without clarity, every transaction becomes guesswork

Merchants and agents worked across telco wallets, cash, and spreadsheets, with no unified place to track or reconcile payments.This created daily friction and uncertainty around transaction status, balances, and cash flow.

3/ BCEAO rules shaping the Flow

Compliance wasn’t optional, it shaped the experience

BCEAO regulation defined strict requirements for:

- onboarding and KYC tiers

- transaction limits

- error handling and reporting

4/ Learning from what already works

The region already showed what simplicity looks like

Benchmarking fintech leaders in Senegal, Ghana, and Côte d’Ivoire revealed consistent success patterns:

- radical simplicity

- transparent fees

- strong confirmation loops

- reliability, even on poor networks

WHAT CHANGED ?

Impact & Outcomes

Successful early-2025 launch

Launched Gozem’s first end-to-end financial experience across Users, Drivers, Agents, and Merchants, introducing a unified wallet and money flows; without disrupting the existing in-app journey.

Strong early activation

Users quickly began topping up through Gozem Money, kiosks, and partner channels, showing that the new experience felt intuitive, discoverable, and naturally integrated into the app’s existing flow

Faster cross-team delivery

Shared patterns for amount entry, method selection, confirmations, and receipts enabled product and engineering teams to ship new money flows faster and more consistently, reducing alignment overhead and rework.

Ready for multi-market rollout

The modular structure of the flows required only minimal changes per country such as local rails, limits, or verification rules; allowing Gozem to scale the financial experience across markets without altering the core user journey

← BACK TO GOZEM MONEY PROJECTS

FINAL DESIGNS

Core experiences & Flow walkthroughs

I designed the core money experiences as a single, coherent system, optimized for fast adoption, trust, and scalability. Each flow follows the same interaction principles while adapting to different user contexts and constraints.

Homepage & Wallet

- One unified wallet card across User, Driver, Agent, and Merchant apps.

- Same core actions (Send, Pay, Top Up, Withdraw, Scan) and behavior everywhere.

- Clear balance visibility and predictable interaction patterns.

Users learn it once, and it works across the entire Gozem ecosystem

P2P transfer

- Amount entered first to prevent failed flows due to insufficient balance or limits

- Beneficiary, then method, since one contact may have multiple accounts (telco, bank, Gozem); this enables choosing the right rail within one unified pattern

- Double verification (recap + PIN summary) to reinforce trust and reduce transfer errors

A guided, confidence-building transfer flow adapted to the region’s multi-rail realities

Merchant payment

- Two entry modes; users can scan a QR code or manually enter the merchant’s number, ensuring flexibility across in-store and informal contexts

- Clear identity confirmation; the merchant’s name, logo, and account details are shown upfront to prevent mistakes and build trust

- Transaction clarity at every step; amount, fees, and funding source remain visible throughout the flow

A fast, transparent payment flow that reduces errors, adapts to varied merchant setups, and reassures users at every step

Designing for future growth

- The method step is fully adaptable, allowing different rails per country (telcos, banks, agents, PSPs) without changing the user journey

- key steps were designed as reusable building blocks to accommodate features like budgeting, shared wallets, ...

- UI and logic anticipate variations in fees, limits, verification rules, and regulatory constraints, ensuring the product scales beyond Togo

A financial experience that solves today’s needs while already prepared for new wallets, new rails, and new markets

Guiding adoption through smart onboarding

- Users are seamlessly activated when they are migrated to Gozem Money, with a simple, low-friction way to discover their wallet and first actions

- New capabilities (P2P, payments, top-ups, etc.) are revealed inside the experience, not through heavy tutorials, ensuring users learn by doing

- Short, in-flow explanations clarify fees, limits, and transaction states, helping users accustomed to USSD understand what’s happening

Faster adoption, clearer understanding, and higher user confidence with minimal friction.

Standing out through ecosystem-driven innovation

- Offline mode; designed fallback states allowing users and agents to complete or resume key actions even in low-connectivity environments

- Ride-to-Kiosk integration; users without cash-in points nearby can book a ride directly to the closest kiosk from the money experience

A solution rooted in local realities and elevated by Gozem’s ecosystem

EXPLORATION

Exploring the design direction

Before locking any solution, I explored multiple experience directions to ensure fast adoption, cross-market scalability, and long-term extensibility. These explorations were reviewed and aligned with product, engineering, and leadership to validate user impact, operational feasibility, and business goals.

1/ Adoption-first money flows for USSD-native users

I explored different levels of guidance, confirmations, and step granularity in core money flows.

Outcome

A clear baseline for P2P, Topup and payment journeys with fewer steps, explicit confirmations, and predictable states, reducing confusion during early testing.

2/ Consistency across wallet-powered experiences

I mapped how money interactions should behave across transport, ecommerce, and standalone transfers.

Outcome

Standardized patterns for transaction states, confirmations, and error handling that increased user confidence in early validation.

3/ Trust and reliability at critical moments

I evaluated how fees, statuses, delays, and errors were communicated throughout transactions.

Outcome

Standardized patterns for transaction states, confirmations, and error handling that increased user confidence in early validation.

4/ Future-proofing the financial experience

I explored how upcoming features such as savings, multi-accounts, and budgeting could fit into existing flows.

Outcome

A modular experience structure that supports new financial features without redesigning core journeys.

Key Decisions (Validated & Aligned)

- Adopt guided, step-based flows as the core interaction pattern: Applied consistently across P2P transfers, merchant payments, agent operations, and top-ups to support fast adoption and clarity.

- Establish a single wallet experience across all Gozem services: Ensured consistency and reduced fragmentation across transport, ecommerce, financial flows, and top-ups.

- Define shared UX patterns for all money interactions: Enabled design and product teams to align on balances, transaction states, confirmations, and trust signals, accelerating delivery while maintaining quality.

The challenge

Gozem needed to introduce its first financial experience and design it from zero, while ensuring it worked seamlessly across four distinct ecosystems: users, drivers, agents, and merchants. Each group had different goals, constraints, and levels of familiarity with digital money.

In our launch markets, money movement was almost entirely USSD-based, not app-based. This meant the experience had to feel immediately understandable, reassuring, and predictable, while still offering the benefits of a modern, app-driven money flow.

The solution also had to scale across services (transport, delivery, ecommerce) and support future additions like multi-accounts, savings, and budgeting without disrupting existing behaviors.

My role was to lead the end-to-end design of this new financial layer; defining the experience principles, core flows, interactions, and patterns that could serve four ecosystems consistently while supporting Gozem’s long-term fintech expansion.

Objective

Design a simplified, trusted P2P and merchant payment experience from scratch, create a scalable financial foundation ready for future features (budgeting, multi-wallets, savings), and establish design standards that align all Gozem products.

My Role

Led research & synthesis

Defined key experience principles

Created modular UI patterns

Designed core flows

Aligned cross-functional teams

Tools

Figma

Jira

Illustrator

After Effect

Cross-Collaboration

Product

Engineering

Data

CEOs & Heads

Legal

Marketing

Building the mobile foundation for

Gozem’s financial services

How I shaped a flexible, system-driven foundation designed to scale across markets,

support evolving financial products, and deliver a consistent, high-trust experience for every user